accident vehicle insurance cheapest cars

accident vehicle insurance cheapest cars

What is a detailed deductible? Commonly, comprehensive deductibles range from, as auto insurance deductible options differ depending on your state regulations as well as insurance policy company standards.

Why you may not want a high extensive insurance deductible? A high insurance deductible can mean that you need to pay more expense in case of a mishap or other protected loss - insurance companies. This can be especially bothersome if you don't have a whole lot of savings or reserve to cover these expenditures. insure.

As an outcome, you may not be able to obtain the complete quantity of protection you require if you have a high insurance deductible. Having a greater insurance deductible makes it more tough to certify for specific discounts.

The most your insurance policy will payout is the vehicle's real cash money value what the automobile was worth on the market prior to the damages occurred minus your chosen insurance deductible amount. You can discuss the real cash money value of your car in the occasion of a total loss by supplying different instances of similar cars and trucks.

Comprehensive insurance coverage cases as well as your prices, The majority of states' insurance laws require that comprehensive claims be covered by the plan. Learn more The exception might be if you submit several insurance claims in an extremely brief duration of time.

The 10-Minute Rule for How To Choose The Best Car Insurance Deductible - Jerry

What is a deductible? An insurance deductible is the quantity you pay of pocket towards repair services for your vehicle due to a covered loss. If you have a $500 insurance deductible as well as you're in a crash that results in $3,000 of repairs to your automobile, you pay only $500 towards repairs (low-cost auto insurance).

liability affordable auto insurance credit score insurers

liability affordable auto insurance credit score insurers

In a lot of markets, when you're not to blame for a crash, we can forgo the deductible if we can identify the various other celebration, that they're at mistake, and also their insurance provider confirms they have valid liability coverage for the mishap. This investigation can take time, so the deductible might use at the start of the case as well as be reimbursed later - insurance companies.

Your insurance deductible only uses when your insurance coverage company pays for your vehicle repairs. There is no deductible if the various other celebration's insurance is handling the repairs.

cheapest car cheaper car car insurance insurance company

cheapest car cheaper car car insurance insurance company

Whether you're a brand-new driver or have actually been behind the wheel for several years, it can be intimidating to wade with insurance terms like "deductible." Your auto insurance coverage deductible influences the cost of your insurance policy, so it is very important that you select one thoroughly (low-cost auto insurance). The deductible that's right for you relies on your private circumstances. cheapest.

Just how does a deductible work? An insurance deductible is the amount of money you pay out of pocket prior to your insurance protection kicks in and starts paying for the costs of your loss. vehicle.

10 Easy Facts About How To Choose The Best Car Insurance Deductible - Jerry Described

Not all insurance protections need an insurance deductible, yet if yours does, you'll choose the quantity. Your deductible will certainly impact your regular monthly insurance policy payment the reduced your insurance deductible, the greater your auto insurance policy premium. When buying quotes from vehicle insurer, experiment with exactly how various deductibles will certainly impact your month-to-month settlements.

Cars and truck insurance plans can consist of various kinds of protection that serve varying functions, as well as you can pick to be covered by some or all of them. State law typically figures out whether or not a deductible is needed.

This covers you if your car rams one more automobile or things as well as you require to pay for repairs. affordable auto insurance. Accident deductibles are typical but differ by insurance provider. If your lorry is damaged by an occasion such as fire, a falling things hitting your windscreen or criminal damage, you'll file a thorough protection insurance coverage case.

cheaper cheap car insurance cheaper car insurance insurance

cheaper cheap car insurance cheaper car insurance insurance

automobile vehicle insurance car insurance

automobile vehicle insurance car insurance

If the various other motorist in a mishap is at mistake yet they aren't guaranteed or don't have adequate insurance coverage to pay for your residential property damage, this type of insurance coverage will certainly pertain to the rescue - car insurance. Deductibles are in some cases needed for this protection, but not constantly, as well as demands vary by state. auto. While your automobile insurance coverage deductible can differ considerably depending upon many elements, consisting of how much you desire to pay, cars and truck insurance deductibles usually range from $100 to $2,500.

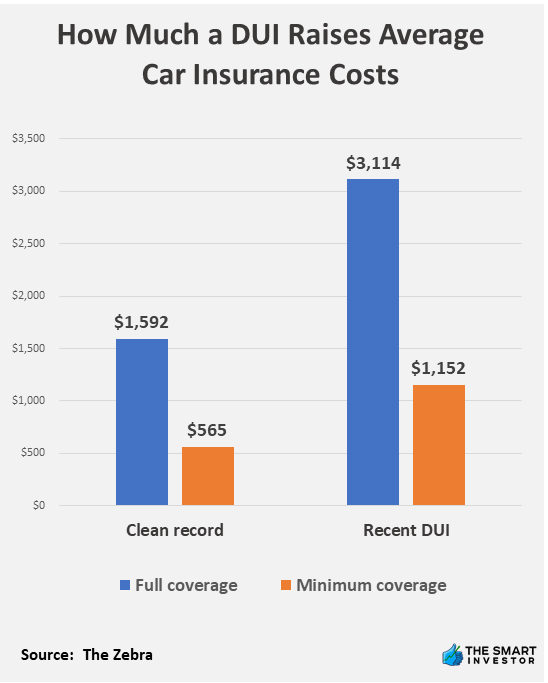

When selecting an insurance deductible, you'll require to consider numerous elements, including your spending plan (dui). Invest a long time calculating just how much you can pay for to pay for a deductible and also just how much you'll save on your monthly premiums by choosing a higher one. Ask yourself these concerns when selecting an insurance deductible amount.

The 10-Second Trick For How Do Car Insurance Deductibles Work? - U.s. News

You need this buffer in case the most awful occurs, however if you're a safe driver or don't drive commonly, using a reserve to cover any type of accidents may be a choice. This is an important inquiry when considering what deductible to choose. If you enter a mishap, can you afford the insurance deductible or would you struggle to pay it? Tackling a high insurance deductible may not make much sense if it represents a huge portion of the auto's value.

Anytime you're in an auto crash as well as there are damages to your cars and truck that would certainly be covered under comprehensive or collision insurance coverages, you'll be accountable for paying the insurance deductible under each of those insurance coverages. You can choose different deductibles within your car insurance plan for both collision as well as thorough. If you have numerous cars and trucks on your automobile insurance plan, you can also choose different deductibles for each cars and truck.

You can select various insurance coverage limitations for every one of them, along with established deductibles, depending upon which insurance coverage it is. credit. Why can't you constantly choose your deductible? Due to the fact that not all protections have them and some, like Injury Defense, have them in some states, and also not others. Deal with your insurance provider to establish just how to satisfy your protection needs.

In brief, a greater insurance deductible amounts to lower insurance coverage costs. A lower deductible equals greater insurance policy costs.

When picking cars and truck insurance policy protection, you selected the low insurance deductible of $500. suvs. The insurer would certainly currently have to pay out $9,500. What if you picked a high deductible of $2,500?