Still, it might additionally bring high unexpected costs if you take place to obtain in an accident, and as we all understand, it is hard to prepare on your own for unexpected expenditures. If you such as to remain on a near course as well as prevent any type of unforeseen costs, the rate for a 0 deductible policy may be worth it for you.

Make certain to talk with your insurance firm for even more in-depth info. Do you constantly have to pay for your insurance deductible? The good news is for you, you don't constantly have to pay an insurance deductible for your insurance firm to cover you - accident.

If the expenses of the problems go beyond the limitation of the at-fault motorist's insurance coverage and you determine to run the remaining expenses via your insurance business, you might still have to pay for the deductible. On the other hand, if you're the one to blame for the mishap, while you might not have to pay the insurance deductible to cover the other chauffeur's expenses, you will still need to pay a deductible for your insurer to cover your own prices.

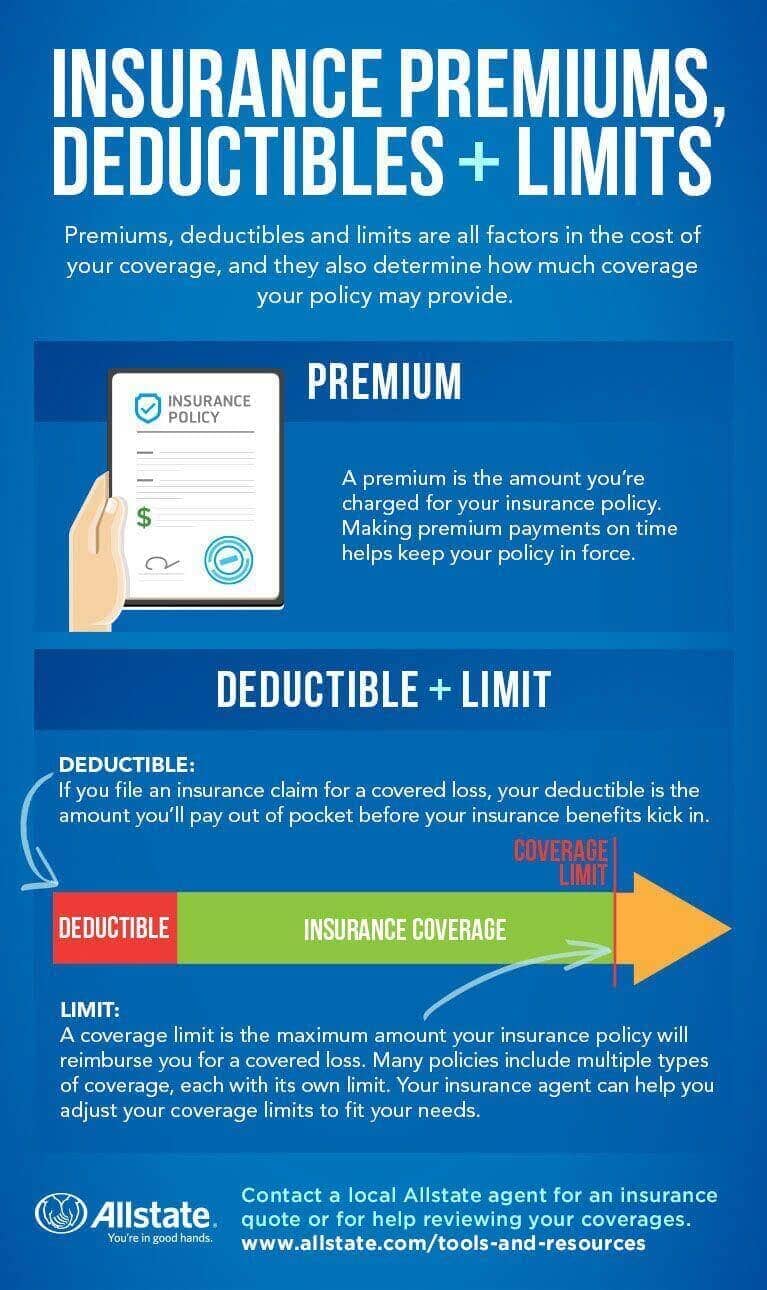

What is the difference in between an insurance deductible and a premium? A premium is the amount of cash that you would pay your insurance policy company in order to maintain your plan energetic. Unlike an insurance deductible, your costs is usually paid on a monthly, annual, or semi-annual basis. laws. Your deductible and your premium go hand-in-hand; if one is greater, than the other will be reduced as a result.

Will raising my deductible in fact save me money? The short as well as basic solution to this question is of course; if you enhance your deductible, you will conserve cash on your costs.

If your insurance deductible is extremely high, You will certainly be liable for paying it in complete every time an insurance claim takes place. Having a high insurance deductible can also adversely influence you in the occasion of filing a tiny case. If the cost of problems you are declaring are less than the cost of your insurance deductible, it will certainly make no feeling for you to even submit the claim.

Some Ideas on How To Choose Your Car Insurance Deductible (2022 Guide) You Need To Know

If Hop over to this website you have an adequate quantity of cost savings to pay a large amount all at when, than it might deserve deciding for a higher deductible. Otherwise, then you will possibly be far better off with a reduced deductible to ensure you will certainly not be left in any type of type of financial bind.

As an example, if you live in a city that has a large volume of little mishaps as a result of rush hour, then a low insurance deductible is possibly your ideal choice as you may be more probable to enter into an accident than a person living in a low populated area - accident.

vehicle insurance cheapest car insurance affordable car insurance cheapest car insurance

vehicle insurance cheapest car insurance affordable car insurance cheapest car insurance

This is so you will not have to pay out such a large amount each time that you make a claim. If you have a very clean driving document, having a greater deductible can be helpful for you. Final thought: You have options Deciding what rate to set your deductible at can be a challenging choice.

Have even more inquiries about your insurance deductible, superior or other coverage choices? Obtain in touch with one of our qualified insurance policy professionals today.

Your cars and truck insurance policy deductible is the amount of money you 'd contribute when your insurance coverage company pays for a protected claim (cheaper car). Just how do vehicle insurance deductibles work?

Anytime you're in an automobile mishap as well as there are problems to your cars and truck that would be covered under thorough or crash protections, you'll be responsible for paying the insurance deductible under each of those protections. If you have numerous autos on your car insurance coverage plan, you can additionally pick different deductibles for each auto (low-cost auto insurance).

Some Known Questions About What Is An Insurance Deductible?.

You can pick various protection limits for all of them, as well as set deductibles, depending on which insurance coverage it is. Why can not you always pick your deductible?

Since they aren't on the hook for as much money, they have much less threat. So they bill a lower cars and truck insurance premium. In brief, a greater deductible amounts to lower insurance costs. A reduced insurance deductible equates to greater insurance costs. An instance would certainly be an insurance coverage with a $500 crash deductible.

When selecting vehicle insurance protection, you selected the low insurance deductible of $500. What if you picked a high deductible of $2,500? They have much less danger, so you'll pay a reduced premium.

This can be danger What happens if like in the example over, you selected a $2,500 deductible yet really did not have that cash money accessible? When you submit an insurance policy claim, you'll be invoiced for your insurance deductible. If you do not have that $2,500 all set to pay you could be embeded a bind with a repair shop.

Should you try to save cash by selecting a higher insurance deductible or really feel even more safe and secure by going with a reduced one? To pick the ideal insurance deductible for you, you'll need to consider your driving history, your emergency situation fund, as well as the expenses of different deductibles, along with numerous other variables.

Key Takeaways Your deductible is the section of expenses you'll spend for a covered claim. Evaluate your cars and truck's worth, your emergency situation fund, as well as the costs of coverage when selecting an insurance deductible. Choosing a greater deductible may help you save cash on costs, yet this indicates you'll need to pay even more out of pocket after an accident.

Things about What Is A Car Insurance Deductible And How Does It Work?

In some states, you might additionally have an insurance deductible for:: Pays to fix your car after damage caused by a motorist without insurance or without adequate coverage.: Pays your medical bills when you have actually been injured in an accident.: Covers the costs of some mechanical repairs, similar to a service warranty.

Whether you pay a deductible after an occasion depends on your coverage, that is at mistake, your insurance coverage company, and your state's legislations. In The golden state, you might qualify for an insurance deductible waiver on your crash coverage, which suggests your insurance firm will certainly pay the deductible if a without insurance vehicle driver hits you. low cost auto.

How Does an Insurance deductible Job? Imagine a tree branch drops on your auto as well as creates damages. You sue on your thorough insurance coverage as well as the repair work shop estimates it will cost $1,000 to deal with. What you'll pay depends upon your insurance deductible: $250 $250 $750 $500 $500 $500 $1,000 $1,000 $0 If the cost of repairing the damages coincides or virtually the exact same as your insurance deductible, you may choose not to sue given that you would certainly lose any kind of claim-free discount rate.

When Do You Pay a Deductible? You'll normally pay your deductible straight to the vehicle repair service shop after they finish the fixings.

As the auto's worth comes down, the opportunity of a complete loss goes upmeaning it might not be worth buying optional coverages. The Kansas Insurance policy Department suggests lugging only liability insurance coverage on cars worth less than $3,000.

Various Other Concerns to Ask When Choosing Deductibles While the 3 aspects above are the most essential when choosing a deductible, you'll desire to ask these questions, as well. Many protection deductibles start at $250 or $500, but some insurance providers use a $0 insurance deductible option for specific insurance coverages, and also others might require higher-risk vehicle drivers to bring higher deductibles.

The Greatest Guide To $500 Or $1000 Auto Insurance Deductible? - Policy Advice

What Kinds of Automobile Insurance Coverage Protection Call For a Deductible? Deductibles are most usual with crash and detailed protection. In some states, nonetheless, you might additionally have a deductible for injury defense or uninsured/underinsured motorist building damage coverage.: If you strike one more automobile or an item, collision protection will certainly assist spend for repair work.

Deductibles are conventional for this kind of protection and also differ by insurer.: Additionally called PIP, this coverage pays medical costs, funeral service expenses, youngster care costs, shed salaries and also various other similar expenditures, despite who caused the accident. PIP is not available in all states and where it is available, it might be required or optional.

Deductible demands can likewise differ by state. What to Take into consideration When Selecting Your Vehicle Insurance Deductible, Selecting an insurance deductible for your automobile insurance coverage policy can be a difficult experience.

Yet if you go expensive, it might be financially ravaging if you need to sue. To help you make the ideal selection for you, here are some things to think about:: A big reserve might enable you to afford a large insurance deductible, which could help you save on monthly insurance coverage expenses - dui.

: If you have actually funded your lorry, your lending institution may require certain types of coverage and also limitations on deductible quantities. While you might be able to pay for a greater deductible, your loan provider may not enable it.: If you've gotten in a number of accidents in the current past, you might be at a higher threat of getting in an additional one, and also a reduced deductible might be a better choice. vehicle insurance.

There's no one-size-fits-all service for everyone, so it is necessary to take into consideration these aspects as well as other facets of your situation to select the right deductible for you. Various Other Ways to Minimize Vehicle Insurance Policy, Selecting the right insurance deductible can offer you a good equilibrium in between saving on your monthly price and also the quantity you owe when you submit a case.

The Best Strategy To Use For What Should My Insurance Deductible Be?

Other means to minimize automobile insurance policy include: Shopping around as well as contrasting quotes from several insurance providers, Applying discount rates that you qualify for, Making changes to insurance coverage amounts, Improving your credit report score, Insurance provider in many states use your credit rating record to develop what's called a credit-based insurance policy rating. They after that utilize this rating to assist identify your price. cars.

suvs money cheapest auto insurance low-cost auto insurance

suvs money cheapest auto insurance low-cost auto insurance

Picking the ideal auto insurance deductible isn't very easy - prices. A high-deductible cars and truck insurance plan brings various monetary consequences than a plan with a reduced deductible.

cheapest car insurance cheapest car insurance cheap car insurance car

cheapest car insurance cheapest car insurance cheap car insurance car

If you file a cars and truck insurance coverage case after a case, the insurance deductible is the amount you pay of pocket before your insurance coverage service provider starts paying for repair services. You will certainly need to pay the deductible each time you submit a claim. For instance, if you have a $3,000 repair work and also a $1,000 auto insurance coverage deductible, you would certainly be responsible for paying $1,000.

If the repair costs much less than the insurance deductible, you'll pay the whole bill. Not all kinds of insurance protection have actually an insurance deductible connected to them.

And also plans with greater deductibles have lower premiums however higher out-of-pocket prices if you sue. When you sue with the insurer, you pay the deductible. The service provider covers prices that go beyond the insurance deductible amount. Auto insurance policy deductibles can range anywhere from a few hundred dollars to $2,500.

Regardless of what amount you choose, it is necessary that you can afford to pay it if you need to file an insurance claim. When picking a car insurance policy deductible, adhere to these six actions to discover which quantity is best for you. There is a relatively uncomplicated partnership between your insurance deductible and also the price you pay for your plan.

3 Easy Facts About Deductible - Direct Auto Insurance Explained

And also remember, you don't have to pick the same deductible for every kind of protection you have. An insurance representative may be able to aid you mix as well as match insurance deductible amounts based on your car's value and also the dangers you face.

If you use the common gas mileage price, you can not deduct automobile insurance coverage premiums as a separate cost. You can still subtract tolls and also parking costs. This consists of automobile insurance coverage as well as the various other items detailed above. If you're not sure which one you intend to use, or which may let you deduct a lot more, it may help to assess the mileage reduction rules.