: If you have actually financed your vehicle, your loan provider may need particular kinds of coverage as well as restrictions on insurance deductible quantities. trucks. So while you might be able to manage a greater deductible, your loan provider may not enable it.: If you have actually gotten in several crashes in the current past, you can be at a greater danger of obtaining in one more one, as well as a reduced deductible might be a far better option.

There's no one-size-fits-all remedy for everyone, so it's essential to think about these variables and various other facets of your situation to choose the right insurance deductible for you. Various Other Ways to Reduce Auto Insurance, Picking the right insurance deductible can give you an excellent balance in between conserving on your month-to-month price and also the quantity you owe when you sue - cheaper car.

Other methods to save on vehicle insurance policy consist of: Buying around and also contrasting quotes from multiple insurance providers, Applying discounts that you certify for, Making modifications to insurance coverage quantities, Improving your credit report, Insurance companies in the majority of states use your credit report to create what's called a credit-based insurance score - vehicle. They then utilize this rating to aid establish your price.

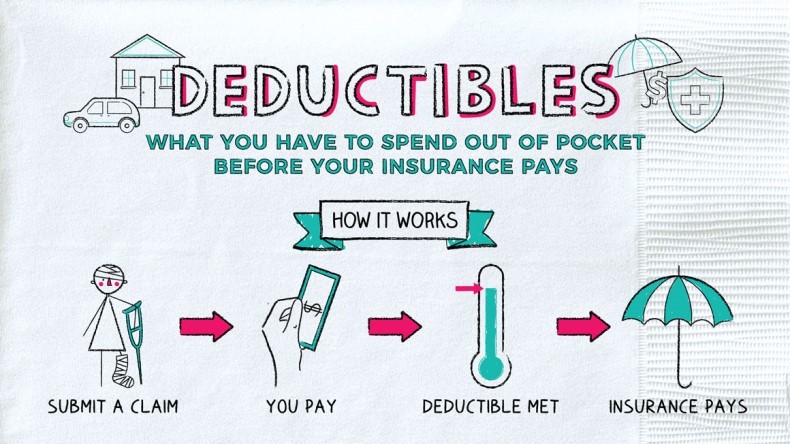

When it involves automobile insurance coverage, a deductible is the quantity you 'd have to pay of pocket after a covered loss before your insurance policy coverage starts. Cars and truck insurance coverage deductibles function differently than medical insurance deductibles with car insurance coverage, not all kinds of protection call for an insurance deductible. Obligation insurance policy does not call for a deductible, however detailed and crash insurance coverage usually do.

When you're including that protection to your cars and truck insurance coverage, you'll usually have the possibility to determine where you wish to set the insurance deductible. Generally, the higher you establish your insurance deductible, the lower your monthly insurance policy costs will be but you do not intend to establish it so high that you wouldn't be able to really pay that quantity if required. auto insurance.

Is Car Insurance Tax Deductible? - H&r Block - Questions

What does a vehicle insurance coverage deductible mean? A insurance deductible is the amount of money you need to pay of pocket prior to your auto insurance coverage will certainly cover the rest - low cost. If you backed your automobile right into a telephone post, your collision insurance would certainly pay for the expense of the damages.

If the complete cost of repair services concerns $1800, your insurance will only pay for $1300. You can find your insurance deductible amounts is listed on your declarations page. Having to pay an insurance deductible ways you can do a type of cost-benefit analysis before you make a case with your insurance company.

We do not sell your info to third parties. What sort of coverage requires a deductible? Not all sorts of cars and truck insurance policy coverage call for an insurance deductible. Liability insurance policy, which covers the expenses if you harm somebody's building or injure somebody with your cars and truck, never requires a deductible. Liability insurance coverage is the backbone of most automobile insurance plan, and also in most states in the U.S - cheap auto insurance., you're needed by legislation to have it.

Accident insurance coverage covers damages to your vehicle from a crash, despite who was at fault. Both crash and compensation coverage typically need that you pay an out-of-pocket insurance deductible but you choose the quantity, and where you establish your deductible will have an affect on your regular monthly insurance premium - liability. How do I choose what my insurance deductible should be? Typically, the higher you set your deductible, the lower your regular monthly costs.

The reverse is likewise real, selecting a reduced deductible methods you'll have to pay a greater costs - affordable auto insurance., but bear in mind, there's a really real opportunity you'll have to pay that insurance deductible sooner or later.

Everything You Need To Know About Your Auto Insurance ... Can Be Fun For Everyone

The vehicle insurance deductible is the quantity of money you will initially be accountable for before the insurance provider begins to cover prices - prices. Unlike health and wellness insurance, car insurance policy deductibles are normally on a per case basis definition you would have to cover these expenses every time you sue.

How does the deductible work? Your deductible, commonly around $750 will certainly be first used to any kind of problems.

The staying $2,750 would after that be covered with the crash coverage by your insurance provider. In some situations where one more chauffeur is at mistake for the mishap you might wish to submit a third-party case versus their Under these scenarios your insurance company might seek a procedure called subrogation to redeem the amounts they have currently paid (cheaper car insurance).

It is additionally crucial to keep in mind that given that automobile insurance deductibles are on a per-claim basis so the regularity of your cases will certainly be one of one of the most important factors (cheaper cars). If your plan has a $500 insurance deductible and also you were associated with 4 different insurance claims of less than $500, after that you would be in charge of 100% of all the payments and also your insurance would have provided no protection.

One method you can take is to consider your driving and also lorry background. If your history shows that you may need to make even more regular claims, you might wish to take into consideration choosing a plan with lower expense expenses. On the other hand, if you haven't had a history of crashes you might not require a low deductible strategy.

Not known Details About What Is A Deductible? - Sonnet Insurance

Whether you're a new chauffeur or have been behind the wheel for many years, it can be intimidating to learn insurance policy terms like "insurance deductible." Your cars and truck insurance coverage deductible affects the price of your insurance coverage, so it's essential that you pick one very carefully. The deductible that's right for you depends upon your individual circumstances.

How does an insurance deductible job? A deductible is the amount of cash you pay out of pocket before your insurance coverage kicks in and also starts paying for the prices of your loss.

Not all insurance policy coverages call for an insurance deductible, but if your own does, you'll pick the quantity. Your deductible will impact your monthly insurance policy settlement the lower your insurance deductible, the greater your automobile insurance coverage costs. When looking for quotes from vehicle insurance policy business, try out just how different deductibles will certainly influence your monthly settlements.

Cars and truck insurance coverage plans can include various sorts of protection that offer varying purposes, and you can pick to be covered by some or all of them. Some of these protection options need deductibles and some don't, so it's worth noting what deductibles you'll be needed to pay. State regulation normally figures out whether or not a deductible is called for. car.

This covers you if your lorry rams one more automobile or item and you require to pay for repair services. Accident deductibles are basic yet differ by insurance firm. If your automobile is harmed by an event such as fire, a falling item striking your windscreen or criminal damage, you'll file an extensive coverage insurance policy claim (laws).

What Is A Car Insurance Deductible? - Insurance Navy - An Overview

If the various other vehicle driver in a mishap is at fault yet they aren't insured or don't have enough protection to spend for your property damage, this kind of protection will involve the rescue. Deductibles are occasionally required for this protection, yet not always, and requirements differ by state. While your auto insurance policy deductible can vary substantially depending on lots of variables, consisting of exactly how much you desire to pay, cars and truck insurance deductibles typically range from $100 to $2,500.

When choosing a deductible, you'll require to think about multiple aspects, including your budget. Spend a long time calculating just how much you can afford to pay for an insurance deductible and just how much you'll reduce your month-to-month premiums by going with a greater one - perks. Ask on your own these inquiries when selecting a deductible quantity.

You need this buffer in instance the most awful occurs, however if you're a risk-free driver or do not drive often, utilizing a reserve to cover any accidents may be an alternative. This is a crucial question when considering what insurance deductible to pick. If you obtain in a mishap, can you manage the insurance deductible or would certainly you battle to pay it? Taking on a high insurance deductible may not make much feeling if it represents a big portion of the automobile's value.

Insurance companies make use of deductibles to help in reducing their threat entailing you, the insured celebration. What Is an Automobile Insurance Policy Deductible? When you need your insurance policy firm to pay for repairs to your lorry, they will require you to pay your insurance deductible (low cost). The insurance deductible is the quantity of money you accepted pay up front for repairs before the insurer begins to spend for the remainder.

Not all vehicle insurance protection calls for a deductible, but you will typically discover a insurance deductible is required for the list below sorts of coverage, according to Progressive: Comprehensive, Crash, Injury security, Uninsured/underinsured driver, The deductible will work similarly regardless of the insurance coverage kind as well as will be called for at any time you make a claim (low cost).

Not known Details About Choosing Your Deductibles To Save Money - National Bank ...

Comprehensive insurance coverage covers things that do not entail another chauffeur. You may also need to pay your insurance deductible if your windscreen is damaged, although some insurer do offer full glass protection as an option. Exist Times When No Deductible Is Called for? There are situations in which no insurance deductible will be called for.

So although you triggered the accident, you do not have to pay anything expense when somebody makes an insurance claim against your responsibility insurance policy for problems you cause to their home or for injuries. Other circumstances where you won't be needed to pay an insurance deductible consist of: An insured driver strikes you.

You choose for totally free repair work on your glass. Being associated with a mishap with another guaranteed chauffeur, where the mishap is regarded their mistake, suggests you will not need to pay a deductible because get more info you'll be making a case with their responsibility insurance. You do have the choice to make a claim through your own accident coverage, if you have it.

When speaking with Allstate, we learnt that, depending upon the state you reside in as well as the insurance coverage carrier you utilize, there is a zero-deductible alternative readily available. Certainly, selecting a zero-deductible option on your insurance coverage will likely result in a higher monthly costs. This is due to the fact that all the danger is currently presumed by the insurance policy company.

Nonetheless, the most effective amount for you will depend upon your monetary situation because your insurance deductible affects your month-to-month costs price. Progressive suggests that you maintain this in mind when determining what total up to set for your insurance deductible: A greater insurance deductible suggests a lower month-to-month costs, however a higher out-of-pocket cost when making an insurance claim.

Our Who Pays The Deductible In A Car Accident? - Anidjar & Levine Diaries

Knowing what your car insurance coverage deductible is and also when you need to pay it is a crucial element of determining what type of insurance policy protection you want. Make certain you'll have the ability to cover the deductible amount when you make an insurance claim to your insurance provider to avoid any type of issues with getting repair work dealt with in a prompt manner (insurers).

For any type of responses or adjustment demands please contact us at. Sources: This material is developed as well as preserved by a 3rd celebration, as well as imported onto this web page to aid individuals offer their e-mail addresses. You might have the ability to discover even more details concerning this as well as similar content at (insurance companies).